I don’t know about you, but I hate paying bills. Forking over money to the metaphorical man is dreadful. We work hard! We deserve to keep it.

Of course, I’m not insinuating that we don’t pay our bills. I’m very diligent about that. What I am talking about is loans — particularly car loans.

Car loans kind of seem like a fact of life when you’re in the thick of them. But when you go a few years without one and then have to take one out again? It’s misery.

I don’t know what your financial situation is, and maybe you think I’m crazy, but it’s my goal as an adult to never have another car loan again.

This post contains affiliate links.

To never have another car loan again may seem unattainable, and honestly, with interest rates so low on car loans, shedding all of your liquidity to not have one may seem ridiculous.

But hear me out.

Here are five reason why this is my goal:

1. Better cash flow

When you have fewer payments, there’s more money in your pocket! Save some, spend some, do what you will! Just be glad it’s in your pocket instead of headed to the bank.

2. You’ll be less resentful of repairs & maintenance expenses

There’s nothing worse than spending hundreds a month on a car payment and then having to drop a few more on new tires, rotors, spark plugs, or what have you. It may also cause you to defer needed maintenance, jeopardizing your safety or the car’s longevity.

Don’t let your car make it feels like it owns you.

3. You’ll have better buying power

Let’s face it, cash is king. If you want to buy a car and don’t need to take out a loan, you’ll have a couple of advantages:

a) You’ll be able to act faster on something that’s a great deal.

b) You’ll have more negotiating power than someone that has to jump through lenders’ hoops.

4. Loans cost money!

If you have great credit, car loans are hard to pass up with rates like 2%, especially if your money is otherwise working for you. But if you’re looking at 7%? your money could be doing better and you’re better off just paying cash. Loans also have other fees, so tack a few hundred extra dollars onto your purchase price.

5. It’s yours

Have you ever had a car loan, you know how good it feels to make that final payment. Now imagine that feeling when you drive it home for the first time!

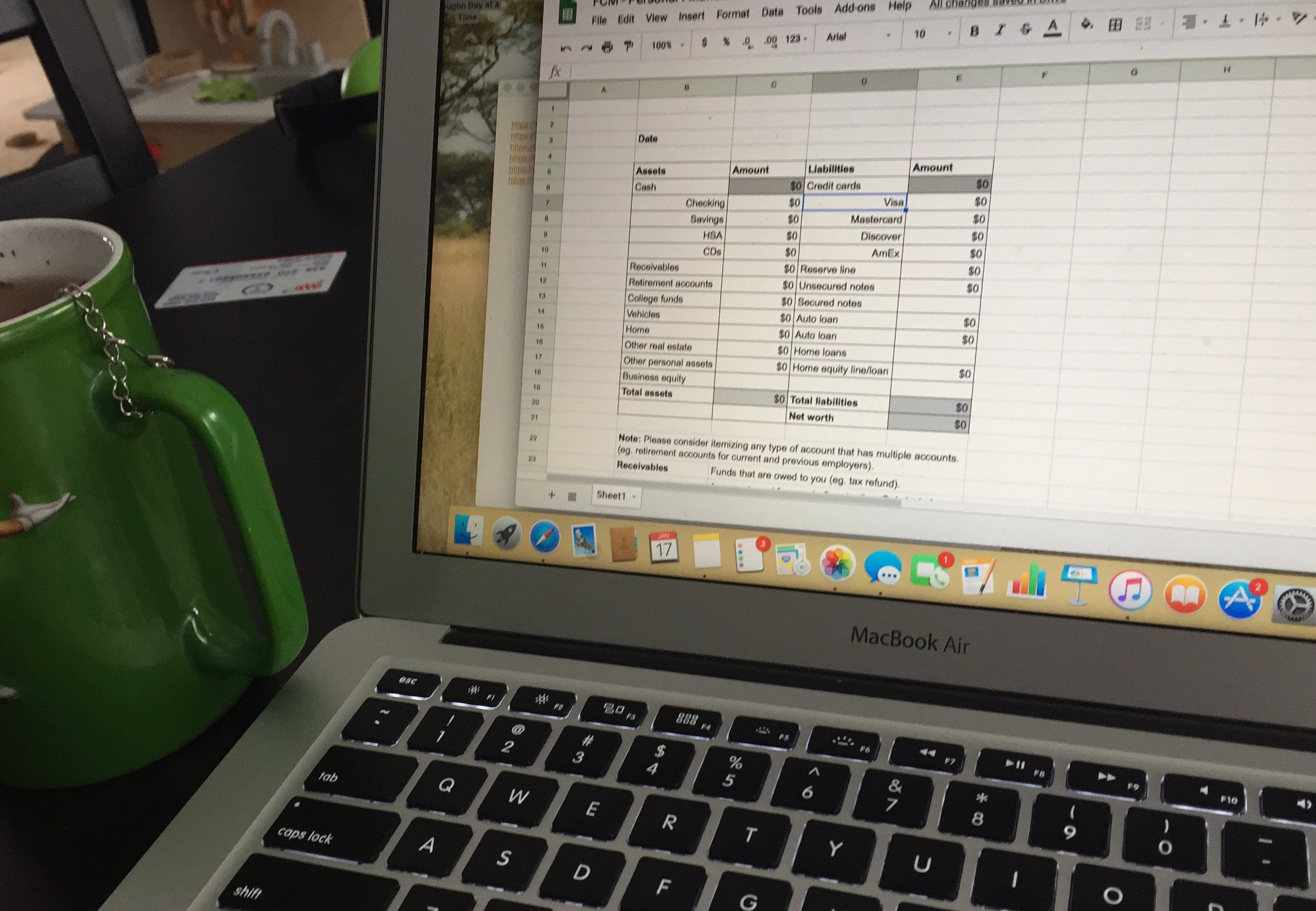

How to save

If you’d love to see yourself without a car payment, but know it’ll be work to get there, here are a few tips for saving:

1. Plan

Look at what you’re currently driving and ask yourself how much longer it will last or when you’d like to replace it. Think about what you’d like to replace it with: Will any life circumstances be changing? Will your needs be the same or different? Will your family grow? Will your commute be changing? Would you like to be more efficient?

2. Don’t get caught up in the new car game.

Whatever you do, don’t buy a new car. I feel like everyone knows this, but new cars aren’t worth it. Buy something that’s a couple of years old and you’ll save thousands. Buy something with a few years under its belt and you’ll save tens of thousands.

3. Save some or all of your tax refund.

This goes along with planning. Estimate how much you’ll receive and figure out what you want/need to do with it, then stick with the plan.

4. Stash cash every pay period.

If you’re willing to pay a bank every month, why not pay yourself? Either set aside a specific amount or — if you have a variable income — figure out how much you need to live off and put the rest aside.

If you must get a car loan, here are some tips to keep it short, so you can keep working toward the goal.

5. Opt for a shorter term

Yes, a longer term note might be available, but if you’re able, opt for the shorter term. The sooner you can pay it off, the sooner you can start to save. If you’re not comfortable making the shorter term loan…

a) Pay extra every month

Maybe it’s just rounding up to the next $10 or maybe it’s an extra $100, but every extra bit you put toward your loan now is less than you’ll have to pay later (and less that’ll acquire interest).

b) Plan to pay it down/off with your tax refund (or other influx of cash)

Again, plan your finances. Large sums of cash can do big things if you play your cards right.

c) Don’t trade in

Trade-ins are meant to get more money in the hands of the dealer. Check on kbb.com to see what your car is worth on the private market and try your hand at selling it. Unless there’s something expensive wrong with it, it’ll likely sell quickly if priced right, landing more money in your pocket.

So have I managed to buy a car without a loan?

Yes, finally.

Between an advantageous home refinance and a hearty tax credit on solar (+ the expense cuts!), we were able to stash enough to not have to finance our car directly.

Isn’t spending a large sum painful?

Of course it is, but making payments is WAY worse. It’s so nice to know that our month-to-month finances will remain unchanged and that we can start to rebuild immediately. Of course, we could have partially financed, but again, loan fees, monthly payments…. the drudgery.

What are your thoughts on car loans? How about leasing? Do you love the new car smell?

Share in the comments below!

— Funky Crunchy Mama