It’s tax season again and today I’d like to share with you an annual tax season tradition in our home: the personal financial statement. I know, I know — finances? Boring! But before you close your tab or head back to Facebook, hear me out.

Yes, finances are boring (usually anyway) and sometimes stressful. But engaging in this purely pragmatic exercise can help you be a better, more prepared parent. Without getting too into the budgeting side of things, it can help you better understand and more effectively communicate your family finances with your children, hence being a more financially responsible role model.

By doing this exercise annually, you’ll be able to:

- Assess how saving for college and retirement are going.

- Figure out how liquid you truly are.

- Look in depth at your debt and your repayment timelines.

By doing these things, you’ll be able to let your children know how many semesters of college you can help pay for, whether or not you can help them pay for a car, and explain to them why you’re driving to Aunt Mavis’ across state instead of going to Costa Rica for vacation.

So the way I see it, knowing and being able to communicate your family finances is good parenting.

Now back to the personal financial statement. Isn’t a tax return a personal financial statement?

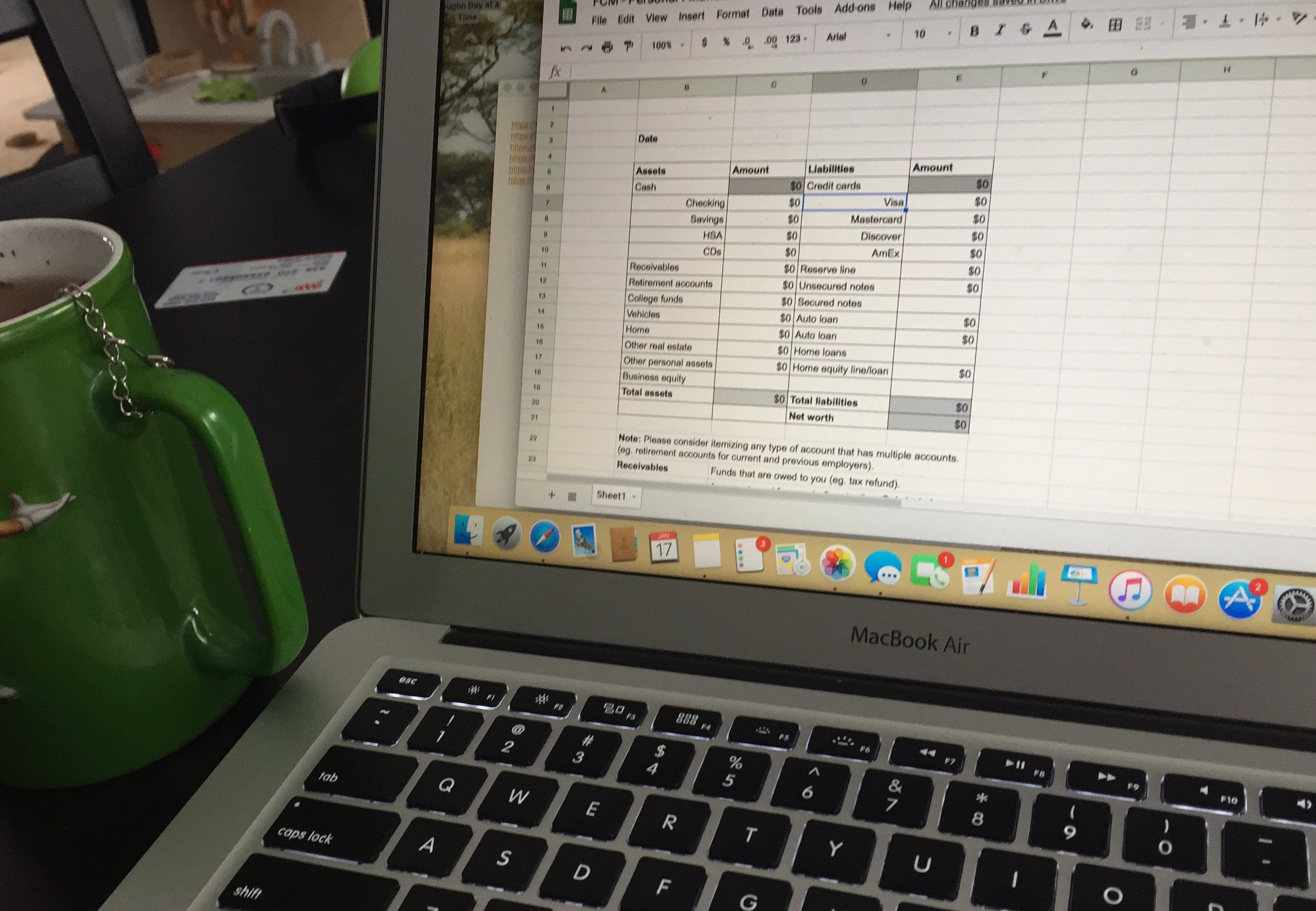

Yes, a tax return is a personal income statement. But what I’m talking about is a personal balance sheet or statement of net worth.

In my regular 9-5, I work as a banker, and these statements are very important in determining creditworthiness, or how responsible the borrower is with money. When you apply for a loan, your lender will ask you about how much your house is worth and what your mortgage balance is. When they’re doing this, they’re creating a personal financial statement and assessing your personal financial status.

You may be thinking, “Well, I’m supplying them with all this information, so I must know, right?”

Let me tell you: There’s something very different about spewing off estimated numbers than there is about seeing it written down in front of you after researching exact balances.

Before I started doing this, I thought I had a pretty good idea as to where we sat financially, but once I sat down and wrote out all of our assets (stuff owned) and liabilities (debts), I was surprised by the results. Sometimes results can be pleasant and sometimes they’re a little overwhelming, but either way it’s better to be in the know than to be blind to your situation.

Here are a few things that you may discover:

- Credit cards: How many do you have (and your spouse, if applicable) and what do their balances total? Should you reduce your number of cards or consider a balance transfer?

- Retirement: Are you on track to retire when you want to?

- Cash/liquidity: How many bank accounts do you have and at how many institutions? Should you close some or open another?

- Home equity: Has the value of your home increased? What’s your mortgage balance?

- In looking at home equity, I like to look at this as both a dollar figure and as a percent (aka loan to value (mortgage balance divided by value)). While I’m not a big fan of borrowing, it’s nice to know how much I could access, if needed. Most banks will borrow up to 75% of a home’s value with a home equity loan or line of credit.

Wanna give it a try? Not sure where to start? Here’s a general template that includes some common accounts that you should consider. It’s also in a spreadsheet so it has an auto-calculation function (hooray!).

I hope you find yourself pleased with the results!

–Funky Crunchy Mama

Awesome article! I wish my parents had taken the time to talk to me about finances. I made so many mistakes when I left home. My husband on the other hand had parents that did talk to him about finances and he’s much better at it. So this is all true!

We sit down in January and have a “Board of Directors” meeting over Quicken. LOL It’s such a good way to meet our goals financially by budgeting and sticking to it.

Love it!

Hi! This post couldn’t be written any better! Reading through this post reminds me of my old room mate! He always kept chatting about this. I will forward this page to him. Pretty sure he will have a good read. Many thanks for sharing!